Post Date: Nov 11, 2021

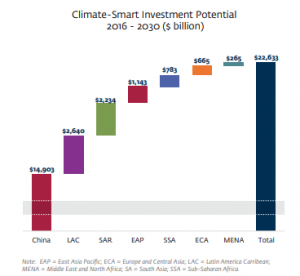

The IFC estimates 23 Trillion USD of new investing opportunities in emerging markets from 2016-2030. The study covers 21 emerging markets that represent 62% of the World population. These regions are also responsible for 48% of Global GHG emissions. Affordability has always stopped corporations and governments from going green. The recent policy changes brought with them a price drop in Climate-Smart Technology. They introduced carbon pricing that is a charge levied on firms for their GHG emissions. This has incentivized them into ESG investing in clean energy like solar and wind power.

Need for Private Investment in Climate Solutions

Countries that signed the Paris Agreement are racing to meet their NDC’s. Climate policies are being integrated into every Government sector. In the current scenario, government funding isn’t enough to mitigate climate crisis. Private funding is being mobilized with subsidies, project support, reduced risks, and high returns. Governments are creating a sustainable domestic enabling system that will attract private investors. Dialogue between investors and governments can remove the barriers in encouraging private investment. Traditionally governments have focussed on R&D, prototype developments, proof of concept, etc. Private firms become necessary for the commercialization of the technology.

Climate Impact to Accelerate Investment in New Markets

The original resolution is to keep the temperature rise below 2 degree Celsius. But the current global average has at looking at 2.7 degree Celsius. At the same rate we could be looking at a temperature rise of 4 degree celsius by 2100. Nations would need 150 Billion USD annually to address the climate crisis. The Lloyd’s Report states that climate related losses have risen to 200 Billion USD each year in the past 10 years. The Blackrock Investment Institute has urged all its investors to incorporate climate change opportunities into their investment portfolios. There is an increased awareness of the climate change risks. Corporates are catching on to the investment opportunities it presents in new markets.

Developing nations are the worst affected by the climate crisis. They will get a better quality of life by indulging in renewables. Investment in emerging markets will also stimulate the socio-economic development there. The governments are supportive of the development and offer plenty of infrastructure aid and subsidies. Labour is also available at cheaper rates than in developed nations. The countries have incorporated green growth into their national development programs.

Let’s look at some of the new investment opportunities in the emerging countries.

Green Infrastructure

The urban population is steadily growing by approximately 70 Million every year. About 70% of the population in developing economies is expected to migrate to the cities by 2025. But the question remains whether the cities are truly sustainable. Cities generate about 70% of the CO2 emissions. The focus should be on urban planning with low emission solutions for carbon-intense sectors.

These include sourcing sustainable building materials, energy and water efficient construction practises, smart water supply, waste management, transport like clean vehicles and electric vehicles, distributed power generation, etc. There is also a significant need for energy-efficient retrofits for existing infrastructure. Investment in improving energy-efficiency of industries also shows much potential. Research and development is required in alternate energy sources and energy efficient equipment and manufacturing processes. Private firms are most often the executors of government-funded infrastructure programs. Governments are indulging in competitive tendering to attract private investment.

East Asia Pacific region which includes China, Indonesia, the Philippines, and Vietnam, are super markets for green infrastructure. China plans to move 250 million people into cities by 2050. It has major scope for clean energy-retrofitting. China alone needs 12.9 Trillion USD for green buildings. Vietnam, Indonesia, and the Philippines combined need 345 Billion. About 70,000 housing units in Vietnam will receive IFC’s EDGE certifications. This will help cut 19,000 MT of GHG emissions. South Asia presents opportunities of 1.5 Trillion for Green buildings, followed by Latin America at 900 Billion. Europe and Central Asia need about 410 Billion. The MENA countries provide investment opportunities to the tune of 92 Billion.

Renewable Energy

In the wake of the Paris Agreement, Countries pledged to reduce their CO2 emissions. Renewable energy sources will soon replace fossil fuels. The key challenges so far have been access to affordable energy and fossil-fuel subsidy reform. Governments are introducing the Carbon price to charge industries on their GHG emissions. The Governments would act as the facilitator for research and prototype developments. Private investment would go towards infrastructure development.

Clean Energy ETF’s (Exchange Trade Funds) can be used to invest in the alternate energy sector. Renewable energy stocks have high returns as green energy is the future. The focus is on integration of clean energy with the grid, net metering, and incentivized distributed energy production. Solar and Wind have proved to be the most viable energy sources. Hydropower is prominent in the Latin American countries. Countries like India are also exploring Waste-to-energy sectors like biomass. China is one of the largest investors in Solar power. They are expected to pour 773 Billion in new renewable energy sources. South Asia follows China with 400 Billion investment portfolios. The other emerging markets roughly need about a 100 Billion each of private investment. The Latin-American countries use market-based auctions to attract private investment in renewable energy.

Waste Management

In 2016, the UN declared that as many as 2 Billion people worldwide have no access to solid-waste management. Fifty Three countries aim to become sustainable in their waste production and disposal. There is an urgent need to move away from landfilling and incineration as waste disposal methods. This is in view of the rising population levels and waste generation. Waste prevention, re-use, and recycling are the key niches for investors in this mission. But there is a considerable knowledge gap in this regard. This is a veritable gold mine for investors as it is a less-explored market.

Solid waste management sector needs investment close to 53 billion USD in the EAP Countries. The investment opportunity is 3 Billion each in the Sub Saharan and European countries. There is need for 3.2 Billion in South Asia, 6 Billion in Latin America, and 4 Billion in the MENA Countries.

Alternative Energy Vehicle Market

A total of 111 countries are focussing on sustainable public transport. This includes bus rapid transit, rail, and clean vehicle fleets. Even if a country’s NDC doesn’t include clean transport, the IFC views it as an inherent part of all sectors because of their interdependency. China actively invests in electric vehicle tech development and manufacturing. Plans to create 4000 Bus charging stations for electric public transport. Electric vehicle battery industry shows major promise for investors. The Lithium titanium oxide tech now allows batteries to last twice as long as Lithium ion phosphate batteries. Corporates can now test their prototypes in a live environment by investing in China.

Argentina alone is allocating 64 Billion for green infrastructure for rail and roads. They anticipate an increase in urban rail capacity to 4 Million passengers by 2023 to reduce traffic and consequent emissions. Moves are also being made to modernize the rail sector with energy efficient tech.

East Asia Pacific and Latin American countries present an opportunity of 1.5 Trillion USD each, followed by Sub-Saharan countries need 500 Billion, South Asian countries need 250 Billion, while Europe and MENA countries need approximately 60 Billion each in investment.

Besides these investment opportunities, ample research needs to go into green restoration. This would present itself in the form of changes in crop, soil, and livestock management, fertilizer recycling in the agricultural sector. The forests need protection and restoration. There should be increased awareness about increasing the resiliency of coastal zones to prevent coastal erosion. This is in practise now in countries in the Asia Pacific belt. This also has potential for nature-based tourism in developing nations that would strengthen the economy.

renewables.org is an experienced platform aggregator for enabling renewable energy projects. We leverage our technical expertise in optimizing clean energy production. With projects spread across Asia and Africa, investors can choose to invest as low as $100. We guarantee a 6% APY on all green investments across diverse portfolios. Make use of our investment options and exhaustive resources on renewables at our site https://fund.renewables.org/.